If you thought filling out car loan application forms were a headache, spare a thought for Marketers and Compliance teams operating in the Auto Finance Industry. Every day, they battle their way through potentially hazardous headlines and dicey disclaimers to ensure content adheres to regulation.

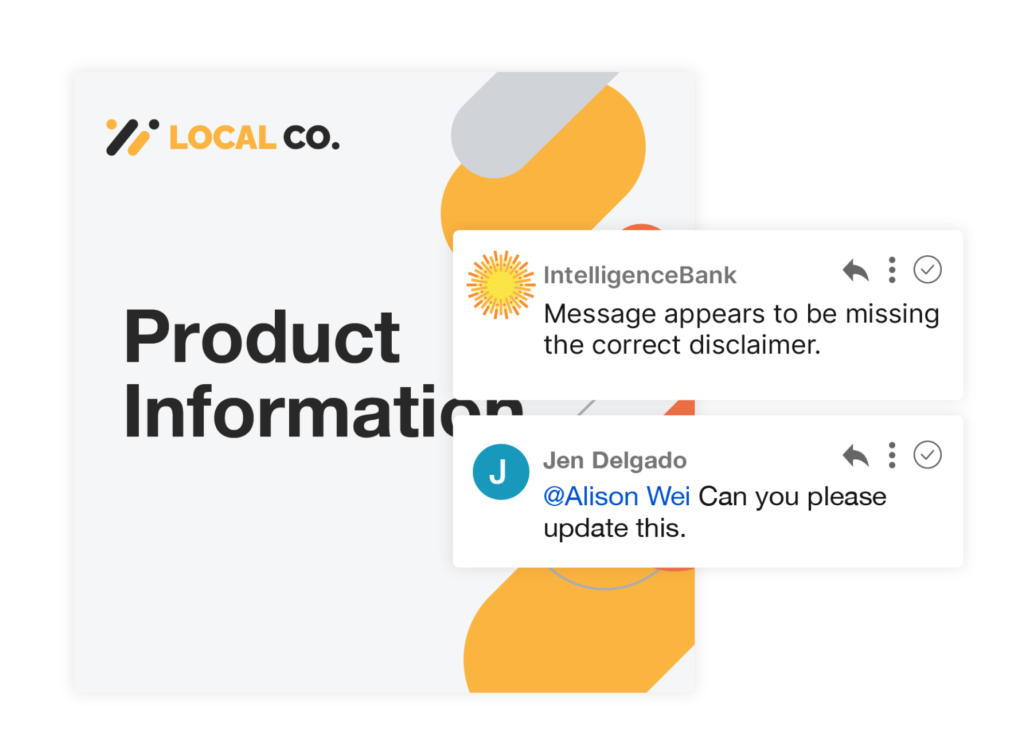

The review notes between the two are legendary for all the wrong reasons. They’re often lengthy and repetitive in nature – correcting fundamental rules, language and brand errors. At times, feedback can be inconsistent depending on who is interpreting the law. Frankly, both teams feel like they’re taking the scenic route rather than a direct road to approval.

Since the introduction of the CARS rule by the FTC in 2023 the marketing compliance spotlight has placed an extra burden on an industry that is simultaneously dealing with increased creative asset volumes. The extra pressure is exacerbating an already tricky dynamic between the two departments.

What Are Examples of Feedback from Compliance Teams to Marketing Teams?

The financial sector is one of the world’s most heavily regulated industries, with strict rules governing everything from major advertising claims to the size of the fine print in product offers. Compliance teams responsible for getting this right have a big job on their hands – particularly in light of the growing volume of digital creative assets being generated year-on-year. Each and every marketing asset must meet legal, regulatory, and internal standards.

It’s therefore unsurprising, the feedback they provide marketing and brand managers revolves around risk reduction—whether it’s adjusting copy to meet disclosure requirements, changing visual elements for brand consistency, or flagging potentially misleading statements or visuals. Here are common examples we found:

- Incorrect or disclaimers that are outdated

- Missing regulatory disclosures

- Failure to Include location specific disclosures

- Requests for specific legal language

- Product-specific disclosure requirements

- Missing disclaimers for third-party partners

- Failure to disclose minimum requirements

While a significant portion of feedback from Auto Finance compliance teams relates to legal requirements, maintaining brand consistency across all marketing materials also formed a large part of the feedback. The type of feedback provided focuses on upholding established guidelines for logos, taglines, tone of voice, imagery and color palettes across all brands, sub brands and partnerships. For example:

- Incorrect brand name usage

- Inconsistent capitalization

- Logo-related issues (size, orientation etc.)

- Inconsistent tone and (switching between past and present participle)

- Language that is not fit for the brand

- Incorrect brand taglines

- Imagery not in line with brand guidelines

- Brand color palette errors

How Does Automation Reduce the Need for Repetitive Manual Reviews in Compliance Checks?

While the importance of reviews is well understood, clients report their ultimate goal is to reduce the back-and-forth between Marketing and Legal. Their concern isn’t about achieving flawless creative assets on the first attempt, but rather the need to address the growing content approval bottlenecks by getting standard rules right.

Feedback loops further compromise Compliance teams’ ability to keep up with reviews as content requirements expand and deadlines shrink. All things combined, there is a gnawing sense of frustration around the time wasted on repetitive corrections – especially those relating to fundamental finance compliance laws. Here are some ways marketing compliance software can help:

AI-Powered Content Risk Detection

Scanning

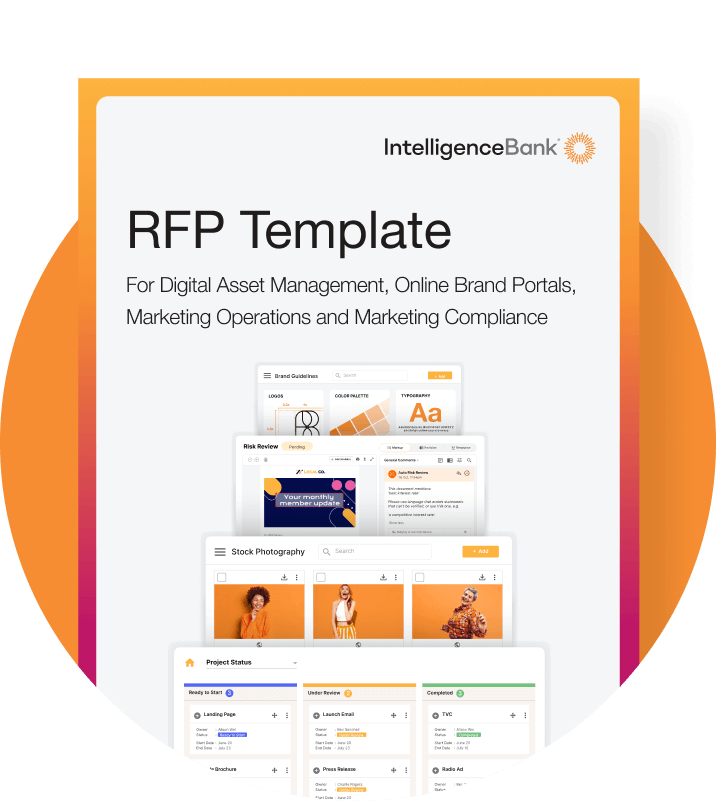

Risky language, such as exaggerated financial claims or incomplete disclosures can all be flagged in real-time either at brief, copy or artwork stage. Scanned reports can even be generated to monitor compliance on live webpages and Google Ads. The platform identifies potential risks using custom rules or pre-prepared industry specific out-of-the-box rule libraries such as FINRA, FDIC and the FCA. This technology allows marketers to take a proactive approach to standard compliance issues before submitting content for final approval. It greatly reduces the manual effort required in the review process while providing a high degree of accuracy.

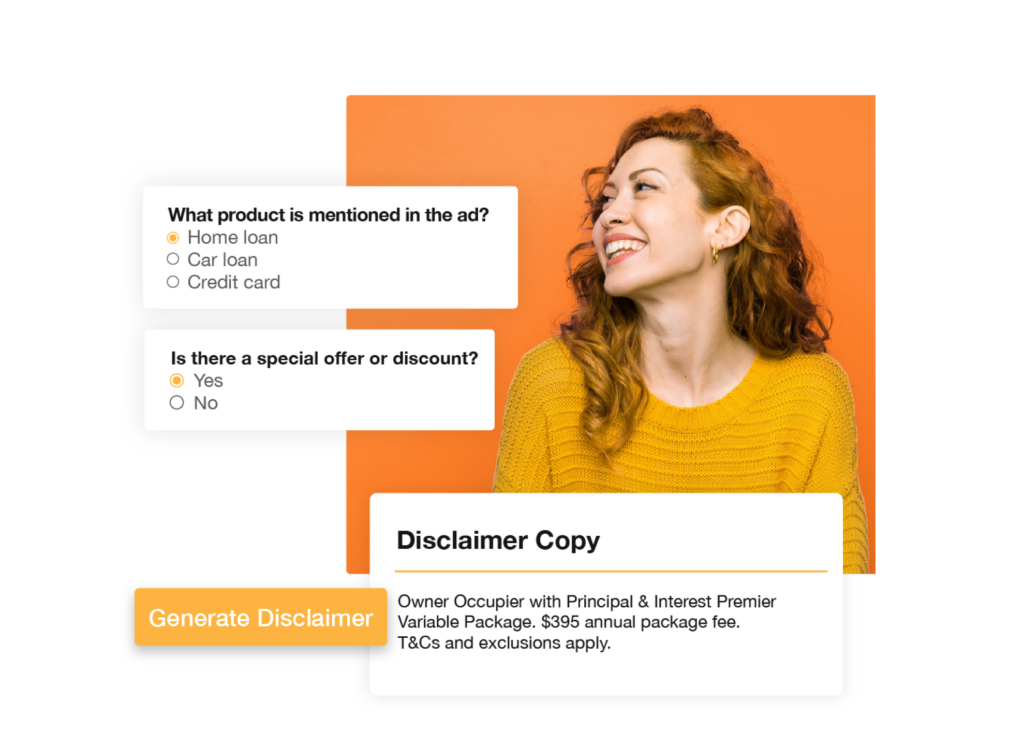

Automated Disclaimer Insertion

The software includes a disclaimer engine that automatically populates briefs with the appropriate legal disclaimers based on the medium, location, and product. This ensures that all necessary legal information is included without manual intervention, streamlining the compliance workflow.

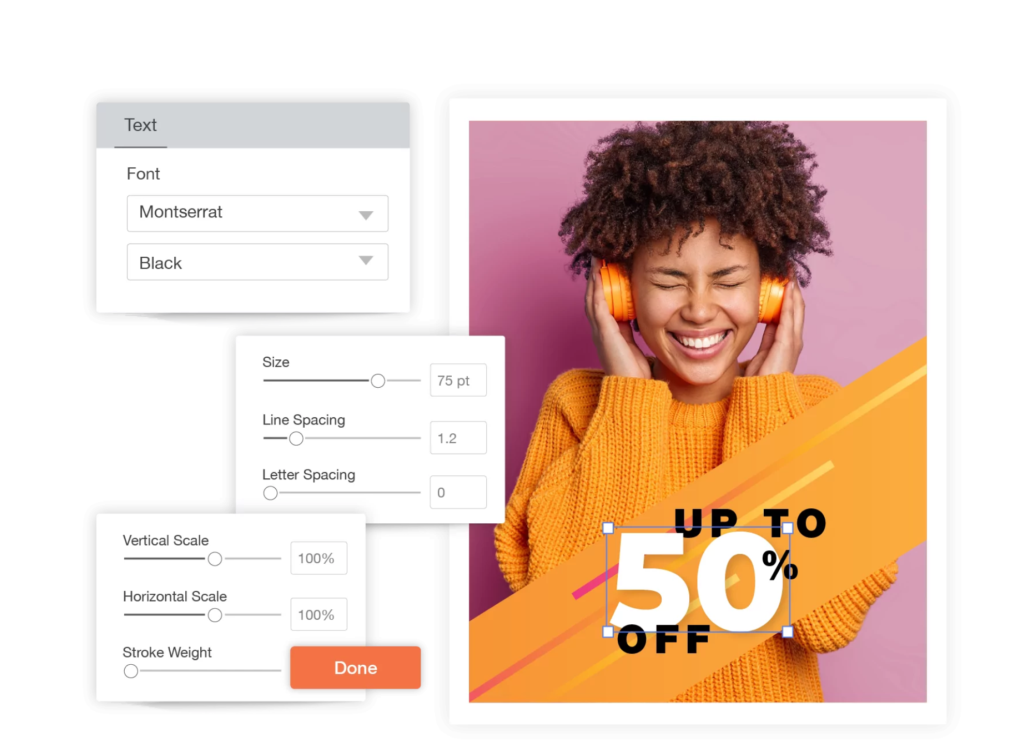

Dynamic Creative Templates

Pre-approved creative templates that lock in essential compliance requirements while allowing for customization are a tremendous help for high volume tightly regulated organizations. They allow marketers to create compliant content efficiently, minimizing the need for extensive manual reviews. They are especially useful when dealing with large remote teams and franchisees.

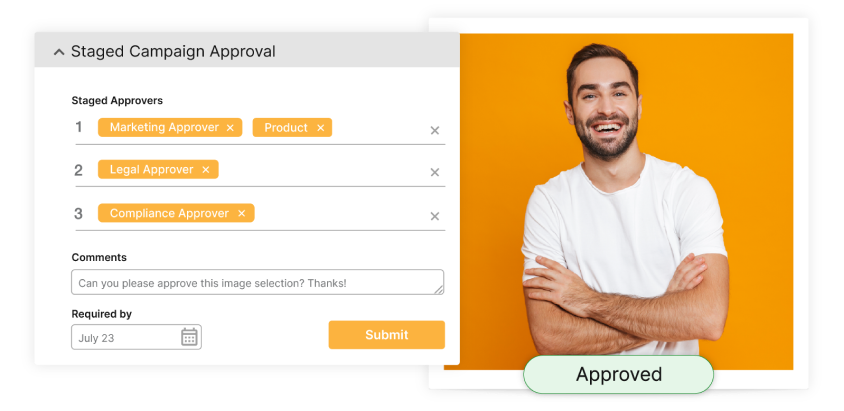

Content Approval Workflow

Automation

Workflows are the vehicle that sees creative production through from brief to launch. They integrate with brand approved assets and importantly provide high visibility to all stakeholders when it comes to review comments, approval history and version control. They incorporate functions such as task management boards, proofing, markups and live content review tracking. Workflows connect to popular third party software like Adobe and Getty as well as your entire digital creative asset repository.

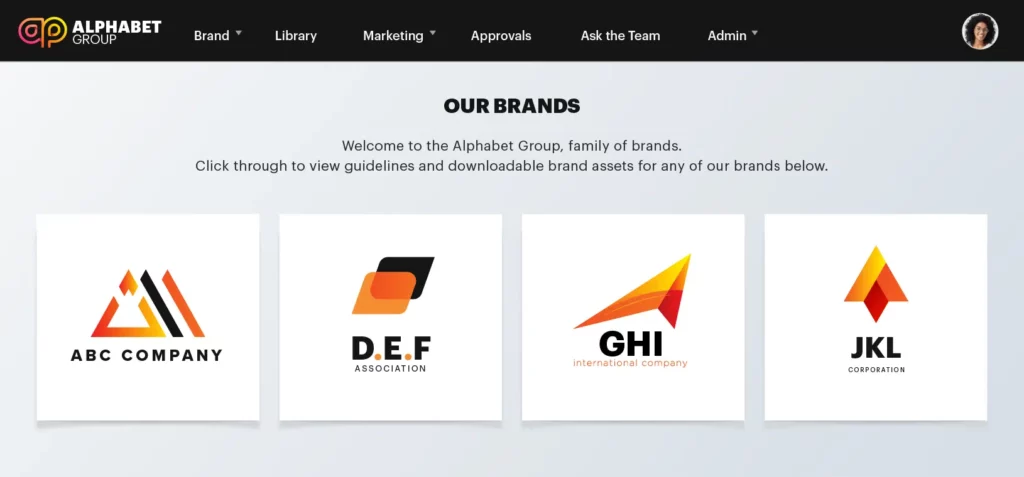

Automated Brand Portals

Online brand portals help stem the tide of marketing requests, automate answers to frequently asked questions and automate access to approved branding elements. Having 24/7 access to the latest downloadable brand assets minimizes the chance of internal and external content creators going off-piste. By using automated brand portals, teams can self-serve, with accurate content that automatically aligns with brand standards reducing the need for multiple rounds of review and approval.

What Specific Legal and Compliance Tasks Can Be Automated to Improve Accuracy and Efficiency?

Disclosure Checks

Automated systems significantly improve the efficiency of checking required legal disclaimers and regulatory disclosures in marketing materials. For example, tools powered by AI can automatically detect whether mandatory disclaimers – such as interest rate disclosures, terms and conditions, or risk warnings – are included in financial ads, insurance offers, or promotional campaigns.

Incredibly, automation can also check the visibility and positioning of these disclosures, verifying that they are placed where consumers can easily find them, following best practices and regulatory guidelines. By automating this task, teams can save valuable time that would otherwise be spent manually reviewing each piece of content, while also ensuring that nothing is overlooked or omitted, ultimately reducing the likelihood of fines or legal challenges.

Risk Identification

Using AI-powered risk scanning tools identify potentially misleading statements or content that could violate compliance regulations. For instance, unsubstantiated guarantees, or misleading representations about a product’s benefits or returns. Automation tools can cross-reference content with predefined risk rules or regulations (such as truth-in-advertising standards or financial disclosure laws), instantly flagging content that might lead to consumer deception or regulatory breaches.

In addition, risk scanning can help identify non-compliant offers, such as promotions that fail to disclose critical terms or conditions, or content that violates advertising restrictions. These automated scans drastically reduce manual effort and human error by quickly identifying risky language or elements, enabling compliance teams to focus on more complex review issues rather than sifting through large volumes of content for potential problems.

Brand Consistency

Automation plays a key role in this process by flagging out of date logos, incorrect fonts, color and messaging. It can even pick up whether logos are scaled correctly, and that the brand’s primary font is used in headings or body text etc. This ensures that all content, regardless of where it is used, maintains the brand’s integrity, protects its reputation, and adheres to legal and compliance standards. In large-scale campaigns, where multiple teams or external vendors may be involved, automation helps guarantee that the brand message is unified and legally compliant across all materials, without the need for multiple rounds of manual review.

How Much Time Can Auto Finance Teams Save with Review Automation?

Previous manual solutions across this volume would allow for sample testing only. You can never get the in-depth comfort that we can get knowing that all of our websites are scanned.

Rebecca Henderson | Head of Marketing, Product & Dealer Performance

Angle Auto

Brought to life in just 30 days, the IntelligenceBank creative repository and workflow platform provided the centralisation and structure needed to manage content creation, approvals and production. This has allowed their business to grow exponentially. You can read more about this solution in our case study.

How Can Automation Enhance Consistency in Language and Terminology Across Marketing Materials?

Consistency is crucial in the financial services industry, not just for compliance, but for brand integrity. Automation can help by:

- Standardizing Terms

Automatically checking for consistent use of legal or financial terms like “annual percentage rate (APR)” or “terms and conditions.” - Enforcing Brand Guidelines

Ensuring that marketing materials comply with internal brand guidelines (e.g., tone of voice, logo placement, color schemes) to maintain consistency across campaigns. - Reducing Manual Checks

Automation reduces the need for manual proofreading, which can be time-consuming and error-prone, ensuring that all content remains consistent across channels.

What Potential Time and Cost Savings Can Automation Bring to Compliance and Legal Review Processes?

Relying on manual processes to perform tasks that can be performed using automation and AI is a no brainer. The issue comes down to the Return On Investment (ROI) of ‘man vs machine’.

With automated tools scanning documents instantly for compliance issues, review times can be cut down from days to hours, or even minutes. The findings from our deep dive into our financial services clients’ review habits allowed us to quantify a range of potential time savings using automation and AI can bring:

- Increased Accuracy

Removing the risk of human omission or inconsistent feedback, automation provides more consistent responses that have been ratified by senior management. - Faster Time to Market

Marketing teams can get their campaigns approved faster, leading to more timely launches and less missed opportunities.

If you’d like to find out more, we’d love to show you. Contact us for a live demonstration.